From Idea to Live

My Roadmap for Systematic Trading Development

I’ve spent years building software, but I’ve never placed a fully systematic trade in my life. That might sound like a strange starting point for a blog on systematic trading, but my background in software engineering is the very reason I’m here. It taught me one crucial lesson: the quality of the final product is determined entirely by the quality of the development process.

A chaotic process leads to buggy, unreliable software. A disciplined, systematic process leads to robust, trustworthy systems.

I believe the same is true for trading. Success isn’t just about being systematic in executing trades; it's about being systematic in how you build, test, and deploy the trading ideas themselves.

My Philosophy: Trading Like a Software Engineer

In software, we have a powerful methodology called Test-Driven Development (TDD). The philosophy is simple: don't write a single line of functional code until you've first written a test that it must pass. The cycle is a disciplined rhythm:

- Write a Failing Test (Red): Define what the code must do and write an automated test for it. This test fails because the code doesn't exist yet.

- Make the Test Pass (Green): Write the simplest, most direct code possible to make the test pass. The goal isn't elegance; it's just to get a working result.

- Refactor the Code: Now, with a passing test as your safety net, you clean up the code. You improve its design, remove duplication, and enhance clarity—all while ensuring the test stays green.

This Red-Green-Refactor cycle forces clarity, prevents over-engineering, and builds incredible confidence in the final product. My entire approach to systematic trading is to build a similar, rigorous routine.

A Trader's Development Roadmap

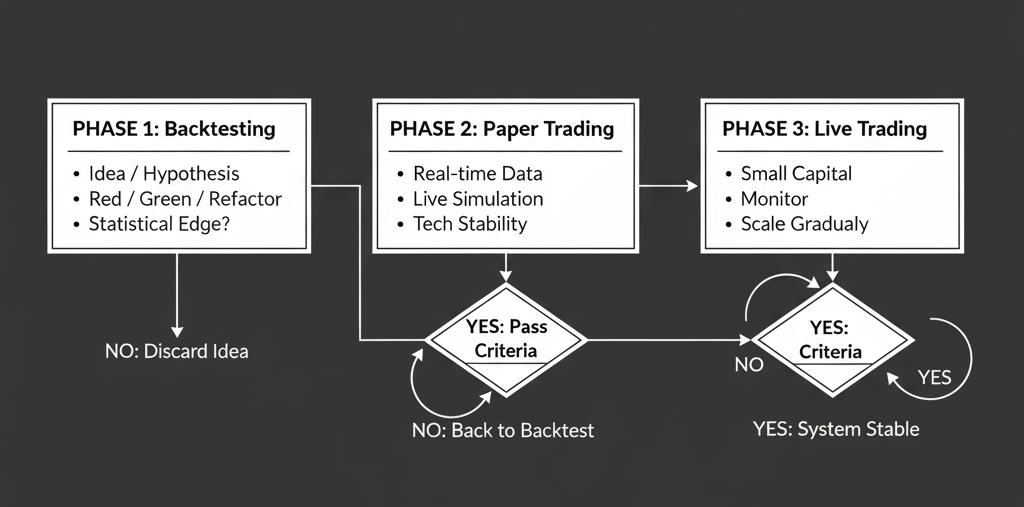

To apply these principles, I've defined a clear, multi-stage roadmap. Every single trading idea, without exception, must pass through these phases before it ever touches real money. The goal is to let bad ideas fail early and cheaply, while good ideas are hardened and validated at each step.

This website will eventually explore each of these phases in exhaustive detail, but for now, here is the high-level plan.

Phase 1: Backtesting (The Unit & Integration Test)

This is where the idea meets reality for the first time. A backtest is a simulation of the trading strategy on historical market data. It’s our "testing suite." Just like in TDD, the goal here isn't just to see if the idea "works," but to understand how and why it works.

- What's the goal? To validate the core logic and see if the idea had any statistical edge in the past.

- What does failure look like? The strategy doesn't meet the predefined success criteria (e.g., profitability, risk metrics).

- The outcome: The vast majority of ideas will—and should—die at this stage.

Phase 2: Paper Trading (The Staging Environment)

Once a strategy passes its historical tests, it graduates to the "staging environment": paper trading. Here, the algorithm runs in real-time on live market data but executes trades with simulated money.

- What's the goal? To see how the strategy behaves in live market conditions. This tests for things a backtest can't, like API connectivity, latency, data feed issues, and broker quirks.

- What does failure look like? The live performance significantly deviates from the backtest results, or the system proves technically unstable.

- The outcome: We gain confidence that the system is mechanically sound and behaves as expected in a live environment.

Phase 3: Live Trading (The Production Deployment)

This is the final step: going live. But just like a responsible software release, we don't go from zero to one hundred. The initial deployment uses a very small amount of real capital.

- What's the goal? To test the full, end-to-end system—including the psychology of having real money on the line—with minimal financial risk.

- What does failure look like? The system breaks down in some unforeseen way, or its performance metrics fall well outside the bounds of what the backtest and paper trading suggested.

- The outcome: If the system performs as expected, we can methodically and slowly increase its capital allocation over time.

A Map, Not a Guarantee

So, that's the roadmap. It’s my blueprint for tackling the world of systematic trading with the same discipline I've learned to apply to software engineering. The process is clear, the phases are logical, and the goal is to build something robust, tested, and trustworthy.

But let me be perfectly honest about the destination. The path laid out on this map is a long one, and I have no idea if it leads to a treasure chest. I am deeply skeptical that it's possible to be consistently profitable in a domain as complex and competitive as the financial markets.

My skepticism is fueled by what I see online every day. On platforms like X, you’ll see screenshots of astronomical profits, but you'll rarely see the context. They share the spectacular success but not the crushing drawdowns, the years of failed attempts, the statistical luck, or the immense risk taken to achieve it. Success without process looks superficial to me, because it lacks the one thing that matters: the story of how and why.

This blog is my attempt to focus on that story.

It won't be a highlight reel of wins. It will be a developer's log—warts and all. My promise isn't to show you how to get rich, but to transparently document an honest attempt to solve an incredibly difficult puzzle. We will focus on the process, the code, the failed backtests, and the small lessons learned along the way.

If you, like me, are more interested in the messy reality of building something from the ground up than in polished success stories, then I invite you to follow along. Let’s see where the map takes us.